Indian Union Budget 2023

1st February , 2023 was redolent with the expectations and premonitions of budget circulating all across the country. All eyes were fixed on Finance Minister Nirmala Sitharaman – as she took to the dais – feeling the expectation and eagerness of a nation on her shoulders. As the budget unfurled – the key features of the same slowly came into light – although garnering some mixed response – overall the shade was pretty much optimistic – even earning it the moniker of – “middle class friendly budget.”

Key Terms to Remember

- Fiscal Deficit : The difference between total revenue and total expenditure of the government is termed as fiscal deficit. It is an indication of the total borrowings needed by the government. While calculating the total revenue, borrowings are not included. Suppose the GDP of a country is 100 crore and the difference between the income and expenditure is 10cr – then the fiscal deficit is 10%.

- Fiscal Consolidation : Fiscal Consolidation is the tendency of the government to spend extra or to check back on it’s expense. It’s largely indicative of what stance a government is taking with its financial policy – aggressive , defensive or conservative moderate.

- GDP : Gross domestic product (GDP) is the standard measure of the value added created through the production of goods and services in a country during a certain period. As such, it also measures the income earned from that production, or the total amount spent on final goods and services (less imports).

- Inflation: Inflation is the rate of increase in prices over a given period of time. Inflation is typically a broad measure, such as the overall increase in prices or the increase in the cost of living in a country. In layman’s terms – inflation negates the buying power of money.

- CapEx: Capital expenditures (CapEx) are funds used by a company to acquire, upgrade, and maintain physical assets such as property, plants, buildings, technology, or equipment. CapEx is often used to undertake new projects or investments by a company.

Prior NET GDP Growth : Inflation Rate

Introduction To The Union Budget 2023

It was pretty clear from the starting pitch that the FM intended to build the new budget on the foundations led by the previous budget. One of the key points that was reiterated over and over again was the fact that gross economic growth of India was almost 7% compared to the 22-23 financial year – the highest among the major economies. What makes this feat even more impressive is that contrary to the western power blocs , India actually was able to able to maintain a neutral political stance on the Russo-Ukrainian War and in fact being able to utilize the situation both to improve the rupee – rouble relationship between the two countries and also to enjoy the supply of NG at a subsidized rate. The G20 presidency also contributed positively in India’s image as a sensible , rising economic superpower. An outline on various schemes and expanding the budget on them were mentioned – namely National Hydrogen Mission , Gareeb Kalyan Yojna( Free Food grains to almost 80 Cr underprivileged families) , National Rural Livelihood Mission ( Aimed at economic upliftment of women via programmes like anganwadi , small scale and large enterprises ) , PM Viswakarma Kaushal Samman ( aimed at artisans to increase their reach by tieups with both domestic and international business houses.

It is noted that the term green energy and the employment scope that the industries bring were highlighted even more in this budget – making it a salient feature in the 23-24 budget.

7 Sections of The Budget

- Inclusive Development

- Infrastructure and Development

- Reaching the Last Mile

- Unleashing the Potential

- Green Growth

- Youth Power

- Financial Sector and Banking

Inclusive Development

This was the first and foremost part that highlighted the ‘’ Sabb ke saath , sabb ka vikaas “ that the PM of India put forward about 2 years ago – efforts under it included both the allocation and introduction of funds to the new and existing projects namely – sustained focus on development of Ladakh and states in the NorthEast.

Infrastructure Development

Agro-Infra:

Digitized Public Infrastructure for Farmers – about raising awareness about pesticide use , upskilling and common technological hub assistance to choose the correct HYV , health benefits to almost 120 crore farmers and agribusinesses were also announced. Modern technology and techniques were also discussed.

However the most highlighted part of this agri-infra tieup was the enhanced stress on millets. India ranks currently as the leading supplier of millet in the world – introducing the west to its health benefits. Sri Anna , Sri Bali are some of the HYV millet strains produced by the ICAR.

About cotton – a public private relationship was proposed that’d involve state government , farmers , federal and orivate companies. The interest free loan lent to states for 50 years can also be used to achieve the same.

PM Awaas Yojna :

Basic shelters with supplies like water , electricity was projected to expand by 66% or 79000 crore rupees.

Railways allotment

Highest amount ever with almost 3.4 trillion – along with establishing 50 new airports, sustainable cities – using both RIDF – Rural Infrastructure Development Fund and Municipal Bonds.

Marginal Community Development

Eklavya Schools : residential schools for tribal children with full facilities and about 38000 teachers vacancy will help not only to empower the backward classes but also to generate employment for educated youth.

Green Growth

Arguably the most highlighted and anticipated part of the budget – it didn’t disappoint. With a grant of almost 35000 crores the FM reminded the nation of the pledge that India took in the COP21 Paris summit to be a zero net emission nation by 2070 to reduce dependency on imported fossil fuels. With the RBI granting almost 16000 crores in green bonds – this bond will only augment to the environmental vision that India has. GOBARDHAN – the bio gas initiative and PM Pranam : launched against the use of chemical pesticide to protect soil sanctity also played a vital part in her speech as the stance about Climatic vision was firmly clear : no compromise with pollution.

Tax exemption on Li batteries and renewable batteries although subtle , will play a vital part in the clean switch to clean energy.

Banking and Financial Development

In order to improve investor protection – certain gurantee and amendments are promised. The amendments include those of BRA – Banking Regulation Act , BOI Act and Banking Companies Act will be revised and amended.

The role of SEBI to enforce , mandate and monitor the market is expected to draw more investors in search of comfort and ease of both investment and withdrawal. The use of an integrated IT portal proposed to be installed will also help to provide logistical support to the companies.

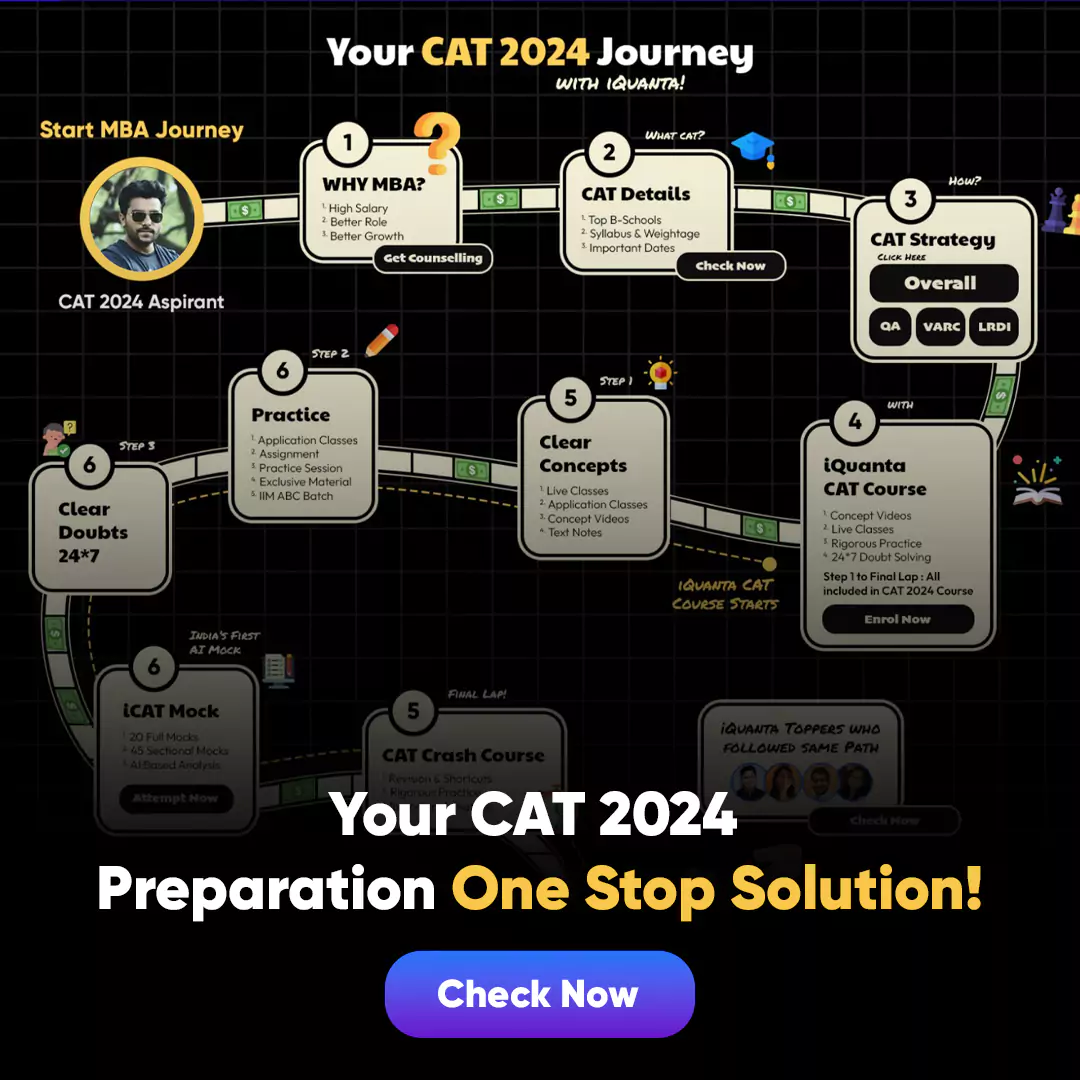

PERSONAL INCOME TAX

One of the most anticipated part of the budget – the common people looked forward to this part with bated breath. The 22-23 budget’s six slab rule only increased to the woes of the middle class and even to some extent lower middle class. However in this budget the number of tax slabs reduced to 5 from 6 with exemption limit extended upto 3L.

Added to that – a clear demarcation between old IT Regime and new IT regime was also another important point that set this year’s budget different.

- Rebate limit increased to 7 Lakhs – no income tax upto 7 lakhs.

Tax Slabs

Direct Tax revenue aimed : 38000 CR

Indirect Tax Revenue : 10000 CR